-

Commercial Invoice For Services카테고리 없음 2020. 2. 8. 22:54

In every business, documentation is an important process in order to have a record on all of the transactions that happen on a daily basis. It is also essential in running the business to ensure that every single transaction is accounted for. There are many types of documents that are used in the business. One example of an important document is an invoice.

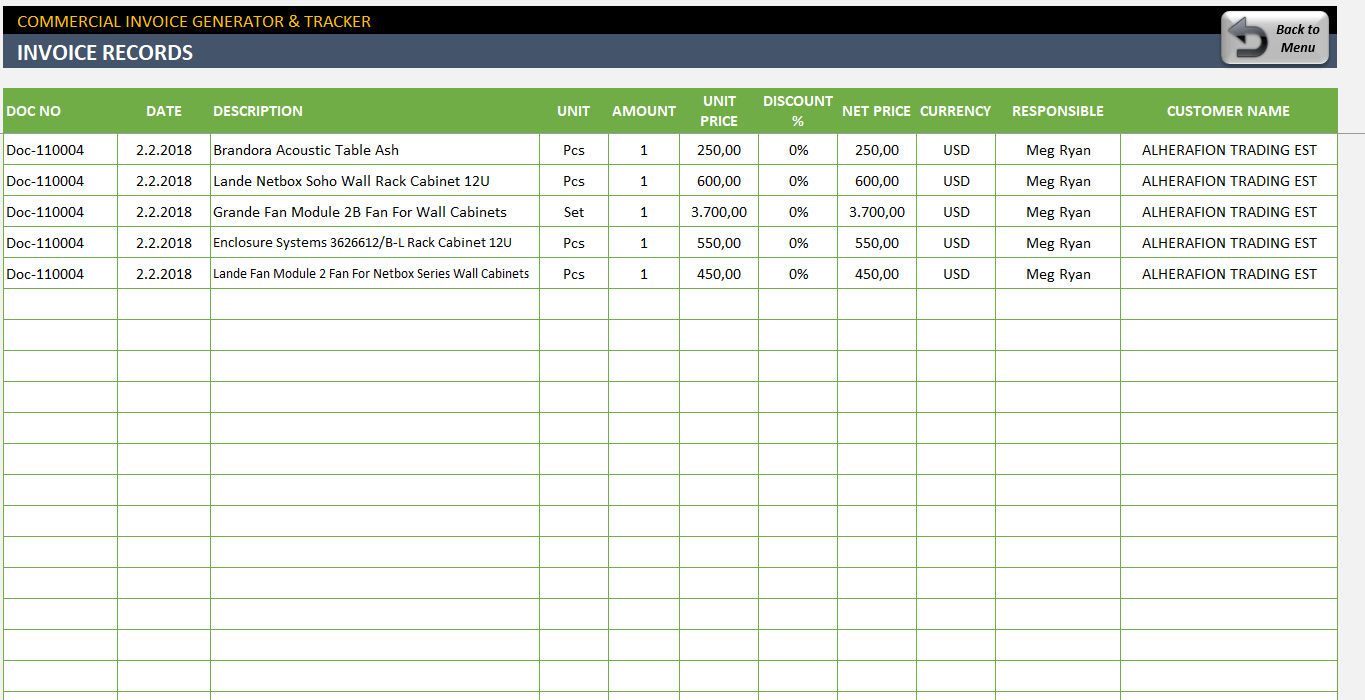

Commercial Invoice Forms & Templates; A commercial invoice is a form identifying the seller and buyer of goods or services, identifying numbers invoice number date, shipping date, mode of transport, port of entry, delivery and payment terms, and a complete listing and description of the goods or services sold including, quantities, prices.

An invoice is either a written or printed document that is used to list down all the products or services that the business has rendered to the client. The main purpose of an invoice is for the business to request for the amount that the buyer is required to pay for the items that he/she has purchased. Aside from that, an invoice is also an essential document that is used to list down a client or customer’s purchase orders. That’s why an invoice is important in every transaction. Although there are different types of invoices, all of these documents basically have the same function but are used for various purposes. To understand the difference between a and a, you can read more information about it below. On the other hand, if you need to create a commercial invoice or a pro forma invoice, or any type of invoice, we have various samples and templates of invoices available for download on this page.

Sample Proforma Invoice. File Format. PDFSize: 13 KBWhat Is an Invoice?As mentioned above, an invoice is a bill or a document that is used to contain the purchases and transactions of the products and services that a particular business is offering. Other than the list of products and services, an invoice also contains the important details of the seller and the buyer, as well as terms of payment, and other important information regarding the transaction. An invoice indicates the number of days until the client is required to pay. Whether you own a small business, a big corporation, or you do freelance work, it is important that you provide one to ensure that you get paid on time and with the right amount.

In addition, there are available on this page to help you start in creating one. Steps on How to Create an Effective Invoice for Your BusinessGetting paid for the services and products that you have is important in order to keep the business running and maintain the cash flow of the business. To help you create an effective invoice, it is necessary that you learn the steps on how to create one. The essential steps for an effective invoice are as follows:.

First, you can create your own outline depending on how you want your invoice to look. You can also download from the, lawn care invoice, printing invoice, and that are available for download should you need to create that type specifically. Now that you have a template, create a header by writing the title indicating the type of invoice that you are creating. Write the name of the business, address, contact information, and email address. You can also add your business or company’s logo to give it a personalized look.

Aside from the business’ details, write the name of the client or recipient of the products and services that have been purchased. This includes the name of the client, their address, and contact information. Write the date when a particular invoice is issued and assign an invoice number to every document that you will create. This will allow you to keep track of the status of the invoice, whether the items have already been processed, delivered, etc. In the invoice, write the payment terms and details such as the terms on how you accept payment whether it is through credit card, cash, or check. List down all the items that the client has purchased from the business. Include the type of service or product, the date, quantity, rate per hour or per item, and the subtotal for each product.

Calculate the total amount by adding the subtotal, tax charges, handling fee, delivery fee, and other additional charges added to the order. Specify when the invoice is due.Sample Commercial Invoice.

File Format. PDFSize: 167 KBWhat Is the Difference between a Pro Forma Invoice and a Commercial Invoice?A pro forma invoice and a commercial invoice are two types of invoices that are commonly used by businesses.

Although these documents have the same contents, both have various differences. The difference between a pro forma invoice and a commercial invoice are as follows:. A pro forma invoice contains information on the goods and items that a particular business is going to deliver to a client, while a commercial invoice is sent to the client after the items have been delivered to the client.

In exporting and importing, a pro forma invoice contains enough information for the purpose of examination by customs officials. A commercial invoice, on the other hand, includes detailed information such as the quantity, value, country of origin, currency being used, etc.

A pro forma invoice also serves as a quotation that is sent by the exporter of the products and goods but does not necessarily mean that these items will be purchased by the client.

Making an invoice can be very confusing. What must be included? Are invoices legally binding? Should Icharge tax?

What kind of invoice do I need?It isn’t that there is no help online; it’s that there is too much. An internet search for “how to makean invoice” returns more than 85 million results – some helpful, if you can find them, andothers not so much.Enter Definitive Guide to Invoicing. We talked to legal experts, studied authoritative publications, andmade our own extensive independent research, all to make invoicing clear and simple for you.

Commercial Invoice Pdf

We alsopainstakingly prepared 144 professional invoice templates to give you a head start on creating your own,and all for free! You can also. An itemized list of goods shipped usually specifying the price and the terms of sale:“The distinction between these two words is actually more a matter of custom and the businessbeing transacted”, a professional editor with expertise in etymology, lexicography anddictionary construction.For example, an attorney charges for billable hours. Work that is commissioned often comes withan invoice. At a restaurant, you get a bill for items already delivered and for which paymentis immediate. From a supplier, you get an invoice for goods ordered or received and for whichpayment is expected.

How does an invoice differ from a receipt? What are these other charges on here? Be clear and concise in labeling shipping, handling or other fees as well as sales tax or ifapplicable.Include a sales tax for taxable items sold to in-state buyers. It’s legally required butcomplicated because, as well as what is considered a, vary by state and even by cities within a state.The, a billthat would change that ambiguity by requiring remote (online) sellers to collect and remitsales taxes, has been languishing in the U.S. House afterbeing passed by the Senate in 2013. Modern day lawyers agree.“An invoice in and of itself is not a “legal document,” according to attorney of the St.

Marie Law Firm Co., L.P.A. “It is simply a request forpayment, no different than if you asked someone for money,” he said.“An invoice is not legally binding because it is not a contract,” Todd C. Scott, an attorneyand legal ethics expert with, agrees. “An invoice is simply a correspondence from the business tothe client informing the client what services were performed on their behalf and/or what goodsare being provided.”.

But just because they are not legal documents it does not mean there is no recourse fornon-payment., an attorney, author, publicspeaker and the president of Big Ideas for Small Businesses Inc., said, “An invoice is areflection of the terms you agree to in a. If the invoice goes unpaid and you, you’re really suing for breach of contract.”In other words, in order to be a legal document, it has to fulfill the requirements of a and therein lies the rub. The legality of contracts is so difficult tointerpret there is a branch of law called. There likely will come a time when you have to correct an error you made on this first invoice.Whether you forgot to charge for something or forgot to issue a credit, you can send out a.Make it clear to your customer that the original bill has been changed, and keep your own records in orderby doing these things:. Change “Invoice” to “Revised Invoice”. Change the date of the revised invoice. Give it the same invoice number but add an “R” at the end.

For instance, invoice 2928 becomesinvoice 2928R. Highlight what charges have changed or have been added. You can do that by changing the color ofthe font, increasing the size of the font, boldfacing it or underlining it. Change the “total amount due” and extend the due date if necessary. Include a cover letter explaining what has changed. Proforma Invoices A proforma invoice, also known as a preliminary invoice, is a quotation of what the proposed goodsor services will be and what they will cost. It includes all the details of the buyer and seller,as well as descriptions of the goods involved in the transaction.

If everything in the proformainvoice is agreed upon, the commercial invoice that will follow will be the same. If the amount orcost of the goods or services is renegotiated, the commercial invoice will reflect those changes.Continue to see. Freelance Invoices A freelance invoice is designed to be used by people providing work in fields such as graphicdesign, photography, copywriting, computer programming, website design and development, consulting,video production, and translation. Although it is much like a service invoice, it offers ways tocharge for services arrived at through different measures. For instance, freelancers could chargeby the word, by the number of images, or by the length of a finished product.Continue to see.